YOU ARE NOT CRAZY. EVERYTHING COSTS MORE.

Ordinary people - - you and I - - are always right about this. What we observe in our day-to-day life corresponds to the reality: Inflation is real. And, we can do things to make it easier to live with.

You listen to the media and you hear confusing news - - statements that do not correspond to your feelings. They say things like “inflation is under control” or “this is within normal”. Lately, they’ve been telling us that inflation is running around three percent per year and that it will trend down lower, to two or so.

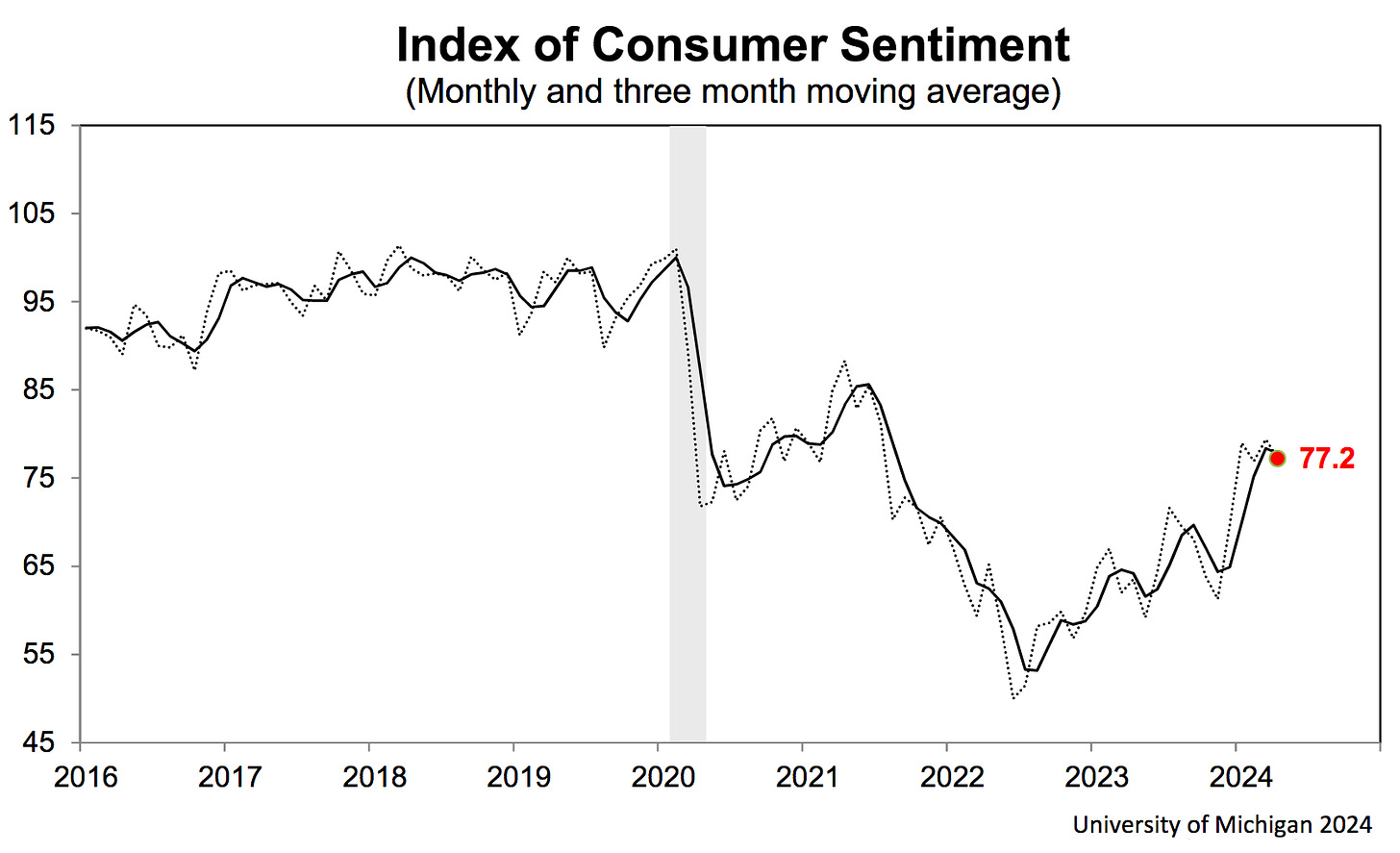

More accurate measures of what life is like for most people paint a troubling picture. The University of Michigan’s Index of Consumer Sentiment says you are dramatically less well-off. Compared to how people felt prior to COVID19, sentiment is still down, 20 percent down!

There are reasons why the “headline inflation” number or CPI (consumer price index) reported in the news doesn’t line up with your reality or the UMich measure of consumer feelings. The biggest reason is that a higher - - and, perhaps, more accurate - - inflation number would cost a lot of people a lot of money.

John Williams of ShadowStats points out that the government started “adjusting” the measurement of CPI in the early 1980s when faced with large COLAs (Cost of Living Adjustments) to Social Security. John has made it his work to create data that is “apples to apples” comparable over time. He believes that a better inflation guess is about eight percent higher than what the current CPI number states.

"By fiscal year (FY) 2024, we will be delivering approximately $1.5 trillion in payments directly to our beneficiaries…" - Social Security Administration

By rough calculation, the last COLA, at around 3 percent, added about $50 billion to that outlay. If John’s right, that number would have been more than $100 billion higher. Yes, a COLA of $150 billion for one year! We’re talking about a lot of money: For comparison, the US military budget for 2024 is $825 billion.

Many other organizations use the CPI when they negotiate pay increases. I was a member of the UAW (United Auto Workers) while at TOYOTA. Ford and the UAW just reached an agreement bumping wages up about four percent, part of which was a COLA. If you believe John’s number, even with the raise, the workers are losing ground.

"COLA is calculated quarterly based on changes in the Consumer Price Index (“CPI”) published by the U.S. government and is included in your paycheck on a cents per hour basis." - UAW / Ford, October 2023

The point is: the CPI is a political number, one that matters to many people, and that is why it doesn’t match your lived experience. Just for fun, I went to a search engine (Oops, I meant “Choose Engine”) to look for an “Online Inflation Calculator”: Guess what it uses for inflation? You guessed it, our government’s CPI number.

There are other shenanigans that take place with the CPI, unemployment, and GDP numbers; I plan a future post discussing the quality of various metrics and how you might use alternative ones to inform your decisions.

Before we talk about what YOU can do about inflation, how about a musical interlude? Here are Misters Bowie and Mercury, from the early 1980s, another time when inflation was high, the economy was stagnant, and people were, well, feeling “Under Pressure”. We called it “stagflation”, a portmanteau of the words "stagnation" and "inflation".

YOU CAN EASE THE PAINS OF INFLATION - - YOUR THREE ACTIONS

You have, essentially, three “levers” you can pull to improve your situation:

You can boost your earnings;

You can draw down your savings;

You can cut your expenses.

A good way to illustrate this is to visualize a water tank, where water flowing in is your earnings, water in the tank is your savings, and water flowing out is your expenses.

To boost your savings, the amount you pour in must exceed what your pour out; drawing down your savings occurs when outflows exceed inflows. I’m going to tackle these three in the order that offers you the most immediate results, so: 1) cut expenses, 2) increase earnings, and 3) drawn down savings.

FIRST, CUT YOUR EXPENSES

The least painful way to do this is to substitute lower cost items. Do you have a favorite - - say, mustard? Is there is another, maybe, 90 percent as good, at half the price? You should begin making all of these trades, immediately. Bargain and bulk shopping is another way to cut your cost of goods. Choosing to bike or walk to the corner store, in lieu of driving, is another, lower cost behavior substitution - - in this case a healthier one to boot!

Control your portions. As in dieting, cut back your “servings” of everything. As they say, use smaller plates and skip some meals. Remember how crazy valuable toilet paper was during COVID?! Try something: Next time you go to the restroom, remember COVID and literally count the number of squares you take from the roll. It’s almost like it is designed to be rationed out by square. Let this shape your thinking … squares, scoops, cups - - units - - cut back your units. Scrutinize purchases carefully: Do I really need this (many shoes)? Do I really need this (new doormat) now?

“Now”. Let’s talk about time. To push spending later in time is another way of cutting costs now. Hmmm. Look at it this way. Let’s say I get twelve haircuts per year at $100 dollars. Clearly, I’m spending $100 per month on haircuts. If I let my hair grow a bit, going six weeks between cuts, I’ve gotten it down eight cuts per year, or about $65 per month - - a cost cut of one third! Note I got the same “haircut” - - this is different than substitution of lower cost as described above. Stretch out your spending.

Time shifting works well to lower the cost for all purchases and works especially well with infrequent, large ones, like vacations, vehicles, and homes. By delaying a major purchase you are spreading, for example, the cost of owning a particular car, over a longer time frame, lowering the cost per period of that car.

NEXT, BOOST YOUR EARNINGS

Are you in a position to ask for a raise? Increased costs of living might be a good discussion prompt. Employers often respond well if you couple this request with a proposal that you work more hours or take on increased responsibility. Another option is to moonlight at a second, part-time job. This might be very easy to do if you live in an area with seasonal jobs, as the employer has built-in, short-term hiring needs.

Do you have a hobbies or a set of skills that lend themselves to a “side gig” or a “side hustle”? You might be able to offer a service in person or online; Or, you might be able to create a product you sell physically or online. Bartering might be the ultimate expression of a “side gig”, where you and another party exchange your goods outside of the formal economy. In the medium- to long-term you might want to upgrade your work skills and credentials - - perhaps even make a career change to one with better pay, wage growth, and insulation from inflation trends.

FINALLY, “INVEST” YOUR SAVINGS

I’m going to throw you a curve ball. I’m going to tell it is very smart to spend some money - - your savings - - when facing inflation. I am going to tell you where. Note: Do not spend your savings supporting the life you lived about ten minutes ago, before you read this piece. No. You should immediately do steps one and two I describe above, boosting earnings and cutting expenses. I want you to use your savings ONLY to better position yourself in regards to those other two “levers”.

One. I love maintenance. You should too. Anything you can do to prolong the useful life of something that you have delays your need to replace it. Your house. Your car. Your dog. Your self.

You should repair the leaky vent, the squeaky brakes. You should have that sensitive tooth checked out by your dog’s vet. You should defer NO medical - - Git er done! Any of these, left unaddressed, exposes you to greatly inflated costs of repair or replacement in the future. And that future is closer: Remember, the time shifting point from earlier? You will also shift that cost forward, earlier in time, which costs you more. [For you smartypants out there, there is also - - throughout this post - - an issue of “hedonic quality adjustment”. Comparing things over time.] Is anything you will buy in the future of the quality of what you did buy in the past? Ok, besides some consumer electronics? This is a board, a piece of lumber 2” by 4”, used to build homes.

Two. I love DIY. You should too. If you pay me $100 to mow your lawn, you are paying me with money that you brought home after you paid taxes and every other expense you incurred to earn it - - let’s say, $200? You might have had to earn $200 to pay me $100 to mow your lawn. Any service that you can reasonably perform yourself - - with a small investment in tools or skills - - is a no brainer. In a future post, I will drill down deeper into this topic: In business, we call this the “insource / outsource decision”.

Three. I love “rightsizing”, and you should too, even though the word is clumsy. During COVID we went from a two-car household to one: We idled a car, immediately, with no more insurance, registration, etc. Do you have a second, unused car, a never-visited vacation property, or other languishing belongings? Often, you incur a cost to carry these: By selling them you generated new funds - - for your savings - - and you cut recurring, inflating costs. Perhaps it’s time to let go of the comic book collection, a form of stored wealth, or “savings”. Reducing the size of your dwelling - - downsizing - - can offer similar benefits, immediately and over the longer term.

Four. I love positioning. You should too. A final piece of advice. Go back, reread this entire post with a new lens, a new mindset. People, places, and things DO benefit from higher inflation. The question is, what people, what places and what things? How can you position yourself - - hedge yourself, if you will - - from the pains of higher costs by becoming that person, in that place, with those things? Could you, should you, move to a place with better prospects, even if you have to spend savings to do so? For a better job, a better lifestyle, a place to grown a garden? This too, will be the subject of a future post: How might one think of allocating assets in a stagflationary environment.

Have I missed anything? Give me your thoughts in the comments. What are you doing to adjust to high costs, while maximizing the quality of your life?

Five. I love this writing. I hope you do too. Thank you for investing your time in this work. You can help me concrete ways. First, subscribe to future work by becoming a subscriber. Second, copy and past the post link into emails, texts, or social and share with others you believe would benefit from reading this post. If this post has saved you some money, consider “investing” your savings as a paid subscriber! Thank you.

wow very interesting!